Language:

Advantages of Forming an LLC in Wyoming

There are some key advantages to forming an LLC in Wyoming - do you know what they are? Learn more in this post.

It is imperative to consider your situation first before putting up a business. Can you run it all by yourself? Do you have adequate capital to sustain the operations and meet the market demand? Are you comfortable with managing it in your office or the comfort of your home? Perhaps you want someone to represent you and your business.

With that in mind, you have to choose a legal business structure. Depending on the state law, you may consider forming a Limited Liability Company (LLC). Most business owners are inclined to set up an LLC. As such, the advantages that it provides continue to satisfy them. Tax efficiency, liability protection, and privacy are some of the things you may enjoy.

You are free to choose where you will establish an LLC. The US does not require the owners to become residents of that state. You can set it up in a state with laws that match your financial capacity and business nature. Yet, if you will act as the registered agent, things can become different.

What is an LLC?

A Limited Liability Company, also called LLC, is a business structure most common in the US. From the name itself, it is a type of business wherein owners’ liabilities are limited. LLC owners are also called members. Since each owner is treated as a sole proprietor, an LLC has a pass-through tax structure. It means that income taxes are not levied on the business itself. The owners pay them instead. As such, taxes paid are reflected on their income tax returns.

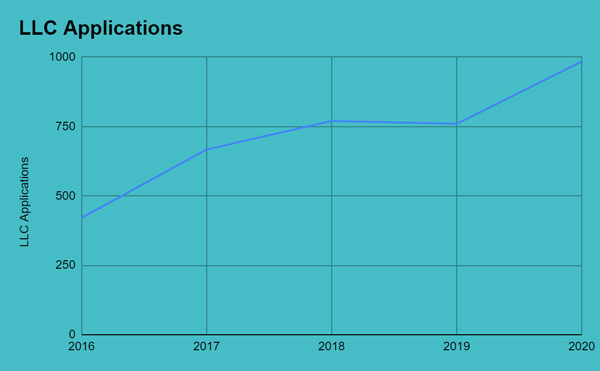

The preference of many LLC owners in Wyoming has become more evident over the past decade. In 2015-2017, LLCs ballooned by 76%, from 20,971 to 36,967. In 2018-2019, a growing number of LLCs were observed. In 2020, business closures started and became rampant due to the pandemic. Even so, LLC applications continued to increase, showing the resilience of many businesses. From 2016 to 2020, LLC applications more than doubled from 421 to 984. It had an average annual growth rate of 26%.

Wyoming is one of the most favored states when it comes to LLC Formation. Each state has its guidelines for LLCs. Yet, Wyoming businesses continue to stand out. The lower fees and the ease in doing business there have been the primary LLC growth drivers in the state. For small business owners, there’s still more to it than meets the eye. Below are some advantages enjoyed by most Wyoming LLC owners.

Why Form an LLC in Wyoming?

Many owners nowadays consider legalities and tax efficiency before setting up a business. A Wyoming Limited Liability Company (LLC) is a business entity that can be put up in Wyoming. It can be viewed as a fusion of a sole proprietorship, partnership, and corporation. An LLC can have many owners with simpler governance. But if an LLC has only one owner or is taxed as a partnership, taxes are directly reflected on their ITR. Yet, liabilities are not extended to personal assets.

For a long time, Wyoming has maintained unparalleled liability protection. Wyoming LLCs do not have to worry about state income taxes and corporate formalities. Like the rest of the states, they don’t have to list their personal information on public records. This is because they can appoint a registered agent service to act on their behalf.

Moreover, there are three LLC Wyoming advantages to brag about. Wyoming was the first state to adopt and improve its LLC statutes, making it one of the best LLC states. It has the strongest and most extended LLC case law history in the US. Lastly, fees are relatively lower compared to other states like Nevada and Delaware.

Top 10 Wyoming LLC Benefits

When it comes to liability protection and LLC statutes, Wyoming remains unmatched. The hassle-free Wyoming LLC Formation continues to entice more business owners. Here are the top benefits of establishing an LLC in Wyoming.

1. Privacy

The personal details of LLC members or owners remain confidential. Wyoming values privacy and does not require you to be listed on public records. Given this, all you need to do is run and grow your business privately. Whether you do it in your home or office, Wyoming can guarantee anonymity.

Other than that, Wyoming provides the service of a nominee director or manager. A registered LLC agent can act on your behalf. This is because the Wyoming LLC law requires the public enlistment of LLC managers. As such, you and your associates will not be listed on public record. The Wyoming LLC manager’s information will be visible to the public, not yours. Even so, the nominee director or manager will not have real authority over your business. It means that his position is in name only. As weird as it may sound, it is like a dummy or puppet. So when there are legal matters, your business will not reveal your information.

This service also serves as a protection for those affiliated with the company. Hence, it can avoid summons, harassment, and unsolicited mails. Moreover, lawsuits can’t associate them with the company. But keep in mind that it is solely for ethical and legal purposes.

2. No Income Tax

Wyoming does not levy state and business taxes on LLCs. This is helpful for Wyoming residents since they won’t have to pay double taxes. Being one of the zero-income tax states, Wyoming remains appealing to many LLC owners. It also implements zero corporate tax, franchise tax, and stock tax.

Other than that, personal income tax is waived. But some LLCs are taxed as a partnership. As such, taxes are passed through owners. These are reflected on their income tax returns.

Keep in mind that the combined state and federal income taxes are about 45%-54% in most states. That way, you will understand that the owners still shoulder the tax burden. It is burdensome for LLCs with a single owner or those treated as partnerships. But since Wyoming does not impose state tax, there will be no double tax filings.

3. No Information Sharing

As discussed earlier, Wyoming does not require the public enlistment of LLC owners. Your details will not appear anywhere. Moreover, the state assures the prevention of state and federal red flagging. This is because the state does not have an information-sharing agreement with the IRS.

4. Live Anywhere

Wyoming requires LLC owners to be at least 18 years old. It also implements few guidelines on Wyoming LLC formation and ownership. If you meet the requirements, you can establish your business there and live anywhere. It is more enticing for non-Wyoming residents and adds an asset protection layer.

5. Legal Protection

The phrase “Piercing the corporate or LLC veil” does not apply to Wyoming LLCs. LLC owners’ details are not on public records. LLC members are not subject to LLC lawsuits. Hence, he is protected from personal liability while running the business. But if there are fraudulent activities, the law may also apply to owners.

Technically, LLC members are those involved in the daily operations of the business. Those who are part of the governing or deciding body are also considered members. The acting members can also receive protection at the discretion of the LLC members. Hence, no affiliated person can be held responsible in most cases.

6. Single-Member LLC Charging Order Protection

Taxes can be more burdensome for single-member LLCs. But protection for members remains high. This protection order for a single-member LLC can protect his assets if he faces lawsuits.

7. Own Without Cash

You can still run an LLC without cash. Wyoming LLCs can offer shares or membership traded for services, money, and properties. So a member can make cash or non-cash payments for services rendered and property bought. It is an advantage to those who want to be LLC members but do not have enough cash or capital. Even so, some LLCs do not adhere to this option as it can cause confusion and misunderstanding.

8. Few Regulations & Formalities

Wyoming LLCs have fewer formalities, unlike corporations. In essence, corporations have directors who decide and vote on their behalf. It also has officers who manage its daily activities. Meanwhile, LLC does not have the same level of formalities. It does not hold shareholder and board meetings.

All you need is a registered LLC agent to act on your behalf. He must be available during normal business days and hours. You can go to the office or manage it at home.

9. Flexible Profit Distributions

Profit distribution is flexible and in Wyoming LLCs. Wyoming has relaxed regulations on profit distribution and the number of LLC members. Given this, a person who owns 5% interest can receive 50% of profits if written in the LLC operating agreement.

10. Minimal Risks

For LLC members, Wyoming LLC benefits are still unmatched. Risks and costs are limited if there are lawsuits. Since it has fewer formalities, “Piercing the corporate or LLC veil” does not apply to Wyoming LLCs. In short, lawsuits cannot extend to the members as long as there is no fraud or breach of fiduciary duties. As such, Wyoming has lower court demands and litigation expenses.

Planning on forming an LLC in Wyoming? Let Doola assist you in every step of the way. Contact us today to schedule an appointment and know more about our offers.

Are You Ready to Form an LLC in Wyoming?

Wyoming LLC benefits remain a favorite of many business owners. Initially, you may be clueless about many things if this is the first time to put up a business, especially an LLC. Yet, with careful preparation, you can ensure a good start for your business. As long as you know and follow the process and submit the requirements, things are simple. Here are the steps in forming an LLC in Wyoming:

1. Choose a Name for Your LLC

You must ensure the adherence of the chosen name to the Wyoming LLC naming requirements. Consider the following:

Is it adherent to the Wyoming LLC naming guidelines?

- The phrase Limited Liability Company or LLC must always follow the name of the company.

- LLC names should not be similar to other companies or agencies to avoid confusion.

- Concerning the previous bullet, the LLC names should be as unique as possible.

- There are some restricted words for LLCs in Wyoming. These include university, hospital, clinic, bank, and attorney. As such, it will need more documents and the involvement of a professional.

The Business Entity Name Must be Available in Wyoming

Do a business entity name search on the Wyoming Secretary of State website. It can help you determine if the chosen name for your LLC is still available.

The Business Domain or URL Must be Available

Since most transactions are done on the internet, you should create your LLC website. You may check if you can use your business name as a web domain. Hence, you must purchase the URL today to ensure the ownership and uniqueness of your web domain.2.

2. Appoint a Registered Agent

A Wyoming LLC registered agent handles legal documents and acts on your behalf. In short, he is Wyoming’s point of contact or representative of your LLC. As long as he is a resident of Wyoming and authorized to do business transactions, you can appoint him.

You may appoint yourself or anyone in the business as a registered agent. But, having someone to handle other important matters will make things easier for you. Hence, you can focus on running and growing your business. You don’t have to worry about your privacy.

3. File Articles of Organization

The Articles of Organization correspond to the Articles of Incorporation. These are a fundamental part of the legal documents in establishing or forming an LLC. You must submit it to the Wyoming Secretary of State and pay $100. There is an additional convenience fee of $2 if you do it online. The filing fee is non-refundable.

You must also file a Consent to Appointment by a Registered Agent. It is included in the Wyoming Formation PDF.

4. Prepare an Operating Agreement

An LLC operating agreement outlines the ownership and daily activities. Even if Wyoming does not require an Operating Agreement for LLCs, it’s better to have one. It prevents future conflict among business owners.

5. Comply with Tax and Regulatory Requirements

In compliance with tax and regulatory requirements with the IRS, you need to have an EIN. The Employer Identification Number (EIN) corresponds to the Social Security Number of LLCs. It is a nine-digit number or identification code assigned by the IRS. It is necessary for opening a bank account, filing taxes, and hiring employees. Even if you convert an existing business to an LLC, you have to get a new EIN.

6. File Annual Reports

LLCs are required to do an annual filing or submit an annual report. It includes LLC information and financial statements. You will have to pay a specific amount for the annual filing or report fee and annual license tax. The annual report fee is $60 for every $250,000 asset. The annual license tax is $50 or 0.0002% of the LLC assets, whichever is higher. Of course, there’s a convenience fee of $2 if you do it online. If the total fee is higher than $500, you have to file it by mail after the online process.

The in-depth information above will help you in forming an LLC in Wyoming. Starting a company can be difficult though, so you need the assistance of professionals. For more information, reach out and seek help from Doola today.

FAQs About Forming Wyoming LLCs

What are the different types of businesses?

A business can take many forms, depending on its needs and nature. These are sole proprietorship, partnership, corporation, and limited liability company (LLC).

What are the primary goals of forming an LLC?

The primary goal is to protect the owners’ security interests from company liabilities. It also aims to maintain privacy by having someone act on their behalf.

Is the tax imposed on LLCs different from the ones imposed on corporations?

Yes. LLCs have a pass-through entity. Hence, owners report business income and losses on their individual income tax returns.

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.