Embrace worry-free

tax filings

Nerdwallet and doola are proud to provide company tax services in the US!

We’ll file your business tax filings with the IRS to ensure that your LLC or C-Corp remains legal and in compliance.

Business-in-a-Box™

doola is for Do’ers.

LLC Formation, Bookkeeping, Business Taxes, and E-Commerce Analytics—one platform, one point of contact, zero stress.

Product Suite

Your Back Office. Simplified.

Each tool is powerful on its own, but together? Game-changing.

U.S. Business Formation

Skip the paperwork. We set up your business so you can start selling faster.

Smart Sales Analytics

Know what’s selling, what’s not, and how to boost your revenue.

Stress-Free Taxes

Stay compliant, save time, and never stress about tax season again.

Seamless Bookkeeping

No spreadsheets, no hassle, just real-time financial insights.

Business-in-a-Box™

Everything you need—Formation, Bookkeeping, Taxes, and Analytics—bundled to save you time & money.

Resources

Why doola?

We don’t just set up your business, we set you up for success.

See how doola stacks up against the competition.

Do It With doola

Build your dream. We’ll handle the rest.

Do It Yourself

Going solo? See how we compare.

Overview

The Growth Playbook For Do’ers

Powerful resources to help you scale smarter and faster.

Essential Reads for Do’ers.

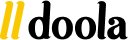

Perks and Rewards

Score $100K+ in Perks

From Top Brands Worldwide.

Exclusive deals, big savings, and founder-first tools.

10,000+ Founders

Built for Founders. Loved by Founders.

doola handled Flagaholics’ legal and financial setup so we could focus on growth & delivering a great customer experience.

Adam Fuller

Co-Founder of Flagaholics

The ease of setup, combined with the resources available through doola, helped me get things done efficiently.

Deon Bryan

CEO at Viteranz

FAQs

What is doola?

Do I need to be a US citizen to work with doola?

Why should I get an LLC and a business bank account?

What information do you need from me to get started?

- Your Company Name

- Your Personal Address

- Phone Number and Email (For contact purposes)

Later in the process, you’ll need a passport to set up your bank account.

What is doola Bookkeeping?

Income and Expense Tagging: You can easily tag your income and expenses to keep track of where your money is going.

Ability to Link Multiple Bank Accounts: doola Bookkeeping lets you link multiple bank accounts to the platform, making it easy to view all of your financial information in one place.

Financial Health Reports: The platform provides financial health reports, giving you an overview of your business’s financial performance to help make informed decisions.

Recordkeeping: doola Bookkeeping helps you keep track of important financial records, making tax season a breeze.

Dedicated Bookkeeping: With dedicated bookkeeping, a human bookkeeper will get to know your business, bring your books up to date, and do your book for you, start to finish.

Overall, doola Bookkeeping streamlines your financial management, allowing you to focus on growing your business.

Can doola help me with my business taxes?

Who is doola Analytics for?

Can doola help me with sales tax and reseller certificates?

Still have a question?

Schedule a free consultation with an expert from doola, today.

Less blah,

More doola.

Join doola and start building today.