A virtual 1-on-1 session with an experienced formation and compliance specialist

can help you stay 100% compliant and avoid IRS fines.

Introducing the total compliance package

Formation

We take care of the complicated stuff, so you can focus on what you do best.

Books

Taxes

Stay in 100% compliance with the IRS.

E-commerce

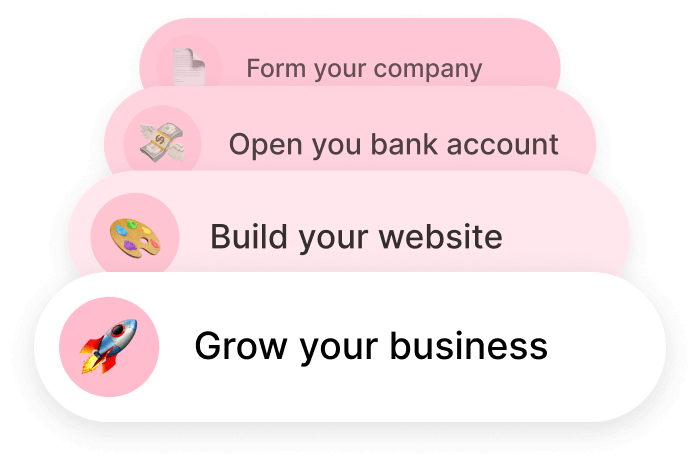

Start your US business today and focus on what you do best

Total Compliance

Monthly subscription

Starter with Expedited processing, Annual State filings, IRS Tax filings, dedicated account manager and 1 free CPA consultation.

Total Compliance

Annual Subscription

Recommended

Starter with Expedited processing, Annual State filings, IRS Tax filings, dedicated account manager and 1 free CPA consultation.

| What’s included? | Total Compliance |

|---|---|

| Formation | |

| Formation Filings doola navigates the complexities of business formation with the state. A step by step wizard guides you through organizing member information, picking a company name, and more. doola’s experts handle all the paperwork to ensure compliance with state regulations. |

|

| EIN doola submits the paperwork to the Internal Revenue Service (IRS) on your behalf once the state has approved your company. The IRS will issue a 9 digit number that allows your business to open a bank account and hire employees in the US. |

|

| Expedited Processing Accelerate your business launch by fast-tracking application submission to the state. The experts at doola will put your formation application ahead of the rest so the state can process it sooner. |

|

| Compliance | |

| Registered Agent Service Ensure compliance and receive a level of privacy from doola’s Registered Agents. Available to act as your address of record with the state, they receive and forward legal documents, tax notices, and other official correspondence from the state or Internal Revenue Service (IRS). |

|

| Operating Agreement (LLCs Only) doola will provide the legal document that outlines the inner workings and structure of the Limited Liability Company (LLC) as set forth by you during formation. The operating agreement includes the rights, responsibilities, and obligations of the LLC’s members (owners) and provides a framework for how the company will be managed and operated. |

|

| Annual State Filings Many states require yearly updates about company structure and charge performance based compliance fees, often called a Franchise Tax. doola handles the calculations and sends updates on your behalf. State charges are not included as part of the filing. |

|

| Tax Support | |

| CPA Consultation Phone consultation with a licensed professional working with doola to provide valuable insights and decision making assistance in fields related to taxation, accounting, auditing, and other financial matters. |

1 Free Consultation |

| IRS Tax Filings doola can prepare your annual tax return for submission to the Internal Revenue Service (IRS). Experts at doola will keep you informed of changes to tax laws and help you claim any applicable credits. |

|

| Financial management | |

| Bookkeeping software Track your expenses, income, and tax deductions in real time. Simply classify a few transactions and doola Books will learn to classify them automatically in the future. Generate core financial documents like an Income Statement or Balance Sheet. |

|

| Customer Service | |

| Dedicated Account Manager Get a dedicated account manager with white glove support to help you run and grow your business. |

Y Combinator

YC S20’s @doolaHQ is the one-stop-shop for US and non-US residents to launch a US LLC, DAO LLC, and C Corp — and today they’re sharing their company formation API with the world, to enable businesses big and small to create a company from the command line.

Ankur Nagpal

You can programmatically create a company or DAO using their API Programmatically create a business, get an EIN, get a US bank account, process payments, file taxes & more Perfect for any “business in a box” startup

Jose Rosado

Thanks to the @StartPackHQ for helping me with this process. Check them out 👇 https://rosa.do/startpack

Mary Ann Azevedo

.@doolaHQ, which describes itself as a “Business in a box” for SMBs, has raised $3M in a seed round of funding. doola provides company formation, an EIN, a U.S. address and bank account, access to U.S. payments and a tax consultation, among other things.

Ankur Nagpal

The good news: You don’t have to be a US resident to start a company in America If you want to start a tech startup, incorporate a C-Corp If you want to freelance or consult with your own business, incorporate a LLC This should be straightforward – use @doolaHQ & you’re good

Alex Lieberman

I haven’t started a business in 8 years. I had to rediscover the mission critical tools for starting & running a new venture. Here’s the stack:LLC registration: @doolaHQ, Trademark filing: @JoshGerben, Domain registration: @GoDaddy, Website: @Shopify, Banking: @mercury, Payments: @stripe, Files: @googledrive, Internal email: @gmail, Extern email: @Mailchimp, Go-to Market: @Kickstarter, Task Management: @asana

Syndicate

8/ We’ve also teamed with @doolaHQ to enable DAOs on Syndicate to get legal entities and EINs, open fiat bank accounts, submit compliance filings, and issue K-1 tax forms easily and affordably. This is just the beginning of new capabilities we’ll be bringing to DAOs, together.

Elizabeth Yin

Congrats to @HustleFundVC portfolio company Doola (formerly StartPack) on their new round! Thank you for letting us invest

Will Papper

We use @doolahq at @SyndicateDAO

Y Combinator

YC S20’s @doolaHQ is the one-stop-shop for US and non-US residents to launch a US LLC, DAO LLC, and C Corp — and today they’re sharing their company formation API with the world, to enable businesses big and small to create a company from the command line.

Ankur Nagpal

You can programmatically create a company or DAO using their API Programmatically create a business, get an EIN, get a US bank account, process payments, file taxes & more Perfect for any “business in a box” startup

Jose Rosado

Thanks to the @StartPackHQ for helping me with this process. Check them out 👇https://rosa.do/startpack

Mary Ann Azevedo

.@doolaHQ, which describes itself as a “Business in a box” for SMBs, has raised $3M in a seed round of funding. doola provides company formation, an EIN, a U.S. address and bank account, access to U.S. payments and a tax consultation, among other things.

Ankur Nagpal

The good news: You don’t have to be a US resident to start a company in America. If you want to start a tech startup, incorporate a C-Corp If you want to freelance or consult with your own business, incorporate a LLC This should be straightforward – use @doolaHQ & you’re good

Alex Lieberman

I haven’t started a business in 8 years. I had to rediscover the mission critical tools for starting & running a new venture. Here’s the stack:LLC registration: @doolaHQ, Trademark filing: @JoshGerben, Domain registration: @GoDaddy, Website: @Shopify, Banking: @mercury, Payments: @stripe, Files: @googledrive, Internal email: @gmail, Extern email: @Mailchimp, Go-to Market: @Kickstarter, Task Management: @asana

Syndicate

8/ We’ve also teamed with @doolaHQ to enable DAOs on Syndicate to get legal entities and EINs, open fiat bank accounts, submit compliance filings, and issue K-1 tax forms easily and affordably. This is just the beginning of new capabilities we’ll be bringing to DAOs, together.

Elizabeth Yin

Congrats to @HustleFundVC portfolio company Doola (formerly StartPack) on their new round! Thank you for letting us invest

Will Papper

We use @doolahq at @SyndicateDAO

Hustle Fund

Congrats team @doolaHQ! Ya’ll ship so well and are continue to make company formation a snap. Appreciate being on this journey with you!

dharmesh

Love the work that @DoolaHQ is doing. Aligns with my philosophy of addressing the “talent is evenly distributed, opportunity is not” issue. More startups everywhere = good for everyone.

Aditya Mohanty

Was blown away seeing how easy @doolaHQ makes it to start an entity in the US, completely online. If you’re planning to build from India for the world, definitely watch out for this team 🔥

Y Combinator

YC S20’s @doolaHQ is the one-stop-shop for U.S. and non-U.S. residents to launch a U.S. LLC and C Corp — and today they’re launching full support for DAO LLCs, bridging web3 and web2:

Sahil Bloom

💥Investment Announcement💥 Excited to invest in @doolaHQ! A business-in-a-box platform enabling founders from anywhere in the world to start their dream US business. Proud to be an investing alongside @NexusVP @ycombinator @dharmesh @ankurnagpal @anothercohen, and more!

Alex Lieberman

I love businesses that go long growth of entrepreneurship. @tryramp for startup spending, @doola for business formation, @carta for equity management and @Rippling for HR & IT

Eric Bahn

I recommend bookmarking this if you start to get serious about angel investing. LLC structures have some great benefits, thank you @arjunmahadevan for the awesome explainer here!

Rohun

you should be able to “start a business” without having to worry about LLCs, bank accounts, taxes, and bookkeeping. my friend, @arjunmahadevan is building this with @doolaHQ here’s why it’s a great biz and you should use them for the next LLC you form.

Hustle Fund

Congrats team @doolaHQ! Ya’ll ship so well and are continue to make company formation a snap. Appreciate being on this journey with you!

dharmesh

Love the work that @DoolaHQ is doing. Aligns with my philosophy of addressing the “talent is evenly distributed, opportunity is not” issue. More startups everywhere = good for everyone.

Aditya Mohanty

Was blown away seeing how easy @doolaHQ makes it to start an entity in the US, completely online. If you’re planning to build from India for the world, definitely watch out for this team 🔥

Y Combinator

YC S20’s @doolaHQ is the one-stop-shop for U.S. and non-U.S. residents to launch a U.S. LLC and C Corp — and today they’re launching full support for DAO LLCs, bridging web3 and web2:

Sahil Bloom

💥Investment Announcement💥 Excited to invest in @doolaHQ! A business-in-a-box platform enabling founders from anywhere in the world to start their dream US business. Proud to be an investing alongside @NexusVP @ycombinator @dharmesh @ankurnagpal @anothercohen, and more!

Alex Lieberman

I love businesses that go long growth of entrepreneurship. @tryramp for startup spending, @doola for business formation, @carta for equity management and @Rippling for HR & IT

Eric Bahn

I recommend bookmarking this if you start to get serious about angel investing. LLC structures have some great benefits, thank you @arjunmahadevan for the awesome explainer here!

Rohun

you should be able to “start a business” without having to worry about LLCs, bank accounts, taxes, and bookkeeping. my friend, @arjunmahadevan is building this with @doolaHQ here’s why it’s a great biz and you should use them for the next LLC you form.

Y Combinator

YC S20’s @doolaHQ is the one-stop-shop for US and non-US residents to launch a US LLC, DAO LLC, and C Corp — and today they’re sharing their company formation API with the world, to enable businesses big and small to create a company from the command line.

Hustle Fund

Congrats team @doolaHQ! Ya’ll ship so well and are continue to make company formation a snap. Appreciate being on this journey with you!

Ankur Nagpal

You can programmatically create a company or DAO using their API Programmatically create a business, get an EIN, get a US bank account, process payments, file taxes & more Perfect for any “business in a box” startup

dharmesh

Love the work that @DoolaHQ is doing. Aligns with my philosophy of addressing the “talent is evenly distributed, opportunity is not” issue. More startups everywhere = good for everyone.

Jose Rosado

Thanks to the @StartPackHQ for helping me with this process.Check them out 👇 https://rosa.do/startpack

Aditya Mohanty

Was blown away seeing how easy @doolaHQ makes it to start an entity in the US, completely online. If you’re planning to build from India for the world, definitely watch out for this team 🔥

Mary Ann Azevedo

.@doolaHQ, which describes itself as a “Business in a box” for SMBs, has raised $3M in a seed round of funding. doola provides company formation, an EIN, a U.S. address and bank account, access to U.S. payments and a tax consultation, among other things.

Y Combinator

YC S20’s @doolaHQ is the one-stop-shop for U.S. and non-U.S. residents to launch a U.S. LLC and C Corp — and today they’re launching full support for DAO LLCs, bridging web3 and web2:

Ankur Nagpal

The good news: You don’t have to be a US resident to start a company in America If you want to start a tech startup, incorporate a C-Corp If you want to freelance or consult with your own business, incorporate a LLC This should be straightforward – use @doolaHQ & you’re good

Sahil Bloom

💥Investment Announcement💥 Excited to invest in @doolaHQ! A business-in-a-box platform enabling founders from anywhere in the world to start their dream US business. Proud to be an investing alongside @NexusVP @ycombinator @dharmesh @ankurnagpal @anothercohen, and more!

Alex Lieberman

I haven’t started a business in 8 years. I had to rediscover the mission critical tools for starting & running a new venture. Here’s the stack:LLC registration: @doolaHQ, Trademark filing: @JoshGerben, Domain registration: @GoDaddy, Website: @Shopify, Banking: @mercury, Payments: @stripe, Files: @googledrive, Internal email: @gmail, Extern email: @Mailchimp, Go-to Market: @Kickstarter, Task Management: @asana

Alex Lieberman

I love businesses that go long growth of entrepreneurship. @tryramp for startup spending, @doola for business formation, @carta for equity management and @Rippling for HR & IT

Syndicate

8/ We’ve also teamed with @doolaHQ to enable DAOs on Syndicate to get legal entities and EINs, open fiat bank accounts, submit compliance filings, and issue K-1 tax forms easily and affordably.This is just the beginning of new capabilities we’ll be bringing to DAOs, together.

Eric Bahn

I recommend bookmarking this if you start to get serious about angel investing. LLC structures have some great benefits, thank you @arjunmahadevan for the awesome explainer here!

Elizabeth Yin

Congrats to @HustleFundVC portfolio company Doola (formerly StartPack) on their new round! Thank you for letting us invest

Rohun

you should be able to “start a business” without having to worry about LLCs, bank accounts, taxes, and bookkeeping. my friend, @arjunmahadevan is building this with @doolaHQ here’s why it’s a great biz and you should use them for the next LLC you form.

Will Papper

We use @doolahq at @SyndicateDAO

No, you don’t! We work with entrepreneurs from around the world to get their businesses incorporated. Don’t take our word for it, though; check out our TrustPilot Page to hear what people globally have to say about doola.

We don’t need any documents to get started. We just need a few pieces of info from you:

Later in the process, you’ll need a passport to set up your bank account.

An Employer Identification Number is the tax identification number for your organization and a requirement of many banks or institutions (such as the IRS) to carry out business in the US. Once your EIN is acquired, you can apply for business bank accounts and payment gateways. Learn more about the full process.

An Individual Tax Identification Number (ITIN) can be used as an alternative for a Social Security Number (SSN) in some cases and is not a requirement in most cases. However, you will be required to have one if you wish to apply for a PayPal account or certain bank accounts. We walk you through how this process looks like in our guide!

A limited liability company is a formal business structure (created as per state law) where the business is legally distinct from the owner(s). It may have a single owner in the case of a Single-Member LLC or multiple owners in the case of a Multi-Member LLC.

An LLC combines the perks of a corporation (protection against personal liability) and a partnership (pass-through taxation). Since the business has a separate legal existence, the members are not personally liable for the debts and obligations of the Company.

State laws stipulate how LLCs should be incorporated. Some states require specific documents, such as the articles of organization, membership agreement, etc., to be filed with the authorities.

Learn more about LLCs and how they work in FREE ebook.

Schedule a free consultation with an expert from doola, today.