The ultimate bookkeeping solution for busy founders

UENI and doola are proud to provide company bookkeeping services in the US!

Keep track of your money.

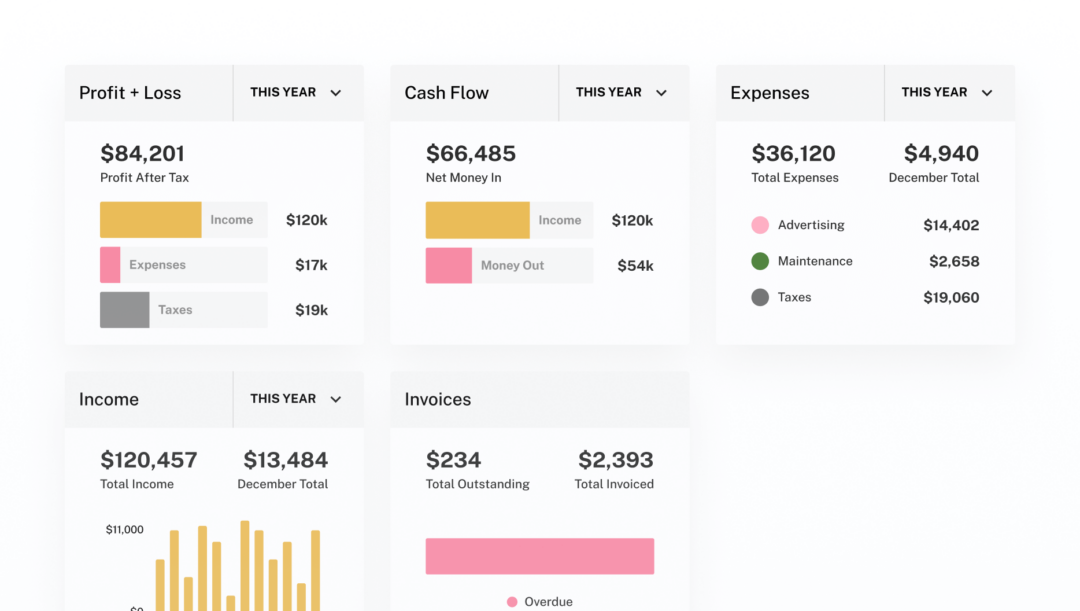

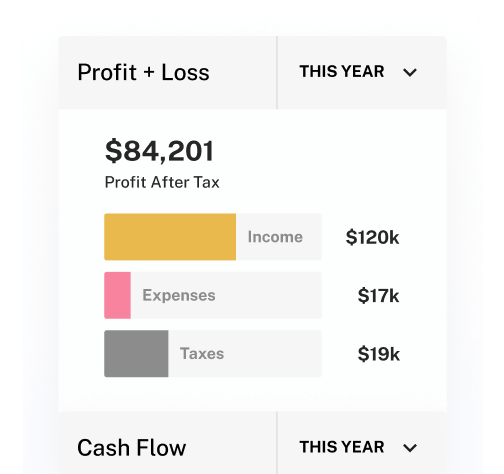

Optimize your financial management with our intuitive bookkeeping software. Connect multiple bank accounts, send and track invoices effortlessly, categorize transactions with ease, and more.

Gain peace of mind with a dedicated bookkeeper.

While software solutions are valuable, nothing beats the expertise of a dedicated bookkeeper who understands your business. Benefit from expert CPA review, quarterly financial reports, and much more.

- Shivani👩💼

- From India

- Has a Dedicated Bookkeeper✍️

- Handling 100+ transactions per month 💸

Software benefits that keep you wow

Amazing solutions for your hassle-free business transactions

Pricing for all our bookkeeping solutions

From invoicing to a dedicated bookkeeper.

- Create customized invoice template

- Manage client lists

- Create or connect merchant processing account via Stripe integration

- Set up recurring invoices

- Collect payments via the invoices you send with Stripe

$50/yr

- Includes doola Invoicing

- Connect multiple bank accounts to manage transactions all in one platform

- Tag and categorize income and expense transactions

- Upload and attach receipts to transactions

- Build automated rules for tagging income or expense transactions

$300/yr

- Dedicated bookkeeping team of Certified Public Accountant’s

- 1,200 transactions / year*

- Categorization of business transactions

- Reconciliation of business bank and credit card accounts (unlimited bank accounts and channels of revenue allowed)

- Ongoing Bookkeeping support

Starts at

$1,500/yr

* Includes up to 5000 transactions per year, depending on the package you select. Contact us to learn more.

University

Learn how to use doola for Invoicing and Bookkeeping with Arjun

Did you know?

Taxpayers can deduct $5,000 of startup costs and $5,000 of organizational costs in the year in which the business begins.

These expenses have to be accounted in the business books of account to be eligible as a tax expense & the receipts also need to be saved and maintained.

What is doola Invoicing?

With doola Invoicing, you can create custom invoice templates to match your brand and streamline your billing process. And using our seamless integration with Stripe, you can now accept online payments for your invoices without the hassle of having to chase down payments yourself. doola Invoicing makes managing client lists and tracking outstanding invoices a breeze. Keep track of all your clients in one place and never miss an outstanding payment again.

What is doola Books?

doola books is a financial management platform that allows you to easily manage your business finances. It offers a variety of features, including:

1. Income and Expense Tagging: You can easily tag your income and expenses to keep track of where your money is going.

2. Ability to Link Multiple Bank Accounts: doola books lets you link multiple bank accounts to the platform, making it easy to view all of your financial information in one place.

3. Financial Health Reports: The platform provides financial health reports, giving you an overview of your business’s financial performance to help make informed decisions.

4. Recordkeeping: doola books helps you keep track of important financial records, making tax season a breeze.

Overall, doola books streamlines your financial management, allowing you to focus on growing your business.

What are the steps for uploading banking transactions to doola Books?

There are several options available to upload your banking transactions to doola Books:

1. Autopopulate doola Banking Transactions: If you are a doola Banking customer, you can choose to have your doola Banking transactions automatically imported into doola Books for income and expense tagging.

2. Link External Accounts: You can link any number of external accounts, including credit cards and merchant processing accounts, to automatically pull external transactions into doola Books.

3. Manually Upload Transactions: If your bank is not supported with the automated linking process, you can easily upload bank statements, and doola Books will populate these transactions in the right place. You can use manual uploads to load transactions for as far back in time as you’d like.

By uploading transactions into doola Books, you can easily track all of your financial activity in one user-friendly platform. This streamlines your financial management process, giving you more time to focus on growing your business.

What is the difference between doola Books and doola Invoicing?

doola Invoicing is a platform designed to simplify your billing process, allowing you to easily invoice and collect payments from your customers. It is ideal for freelancers or small business owners who need a simple invoicing solution.

On the other hand, doola Books is a full bookkeeping software that includes all the features of doola Invoicing and more. It provides a comprehensive solution for managing your business finances by allowing you to track and tag all your income and expenses. You can even upload receipts to specific expenses, making it easier to organize your financial records and prepare for tax season.

In summary, while doola Invoicing streamlines your billing process, doola Books offers a complete financial management solution for small business owners who need advanced bookkeeping features beyond invoicing.

Why is bookkeeping important for businesses?

Bookkeeping is an essential aspect of business management, enabling businesses to manage their finances efficiently, comply with legal and tax obligations, and make informed decisions about their operations and growth.

Still have a question?

Schedule a free consultation with an expert from doola, today.

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.