E-commerce

Everything you

need to launch your

E‑commerce company

Whether you’re an Amazon Seller, or starting a business on Shopify, doola has you covered with everything you need to go from idea, to first dollar hitting your US business bank account.

Supercharge your E-commerce with our specialized services

Insurance

Safe and secure

insurance for founders

Quote, bind, pay for, and actively manage insurance policies in a matter of seconds. Choosing the right business insurance can help protect you from costly risks and liabilities.

Books

Stress-free bookkeeping

for busy founders

Whether you need a way to manage your invoicing process or want to take complete control of your business finances, doola has you covered.

Taxes

Worry-free tax filing

doola prepares and files all tax forms for independent contractors, freelancers, startups, e-commerce owners, and service vendors, ensuring a worry-free experience.

Understanding founders’ needs

At doola, we are founders ourselves, which is why we understand the unique challenges and needs of e-commerce entrepreneurs. Our experience translates into results.

10K+

founders

1000+

5 star reviews

175+

Countries

6

Continents

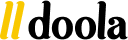

How it works?

1

Form your company

As soon as we get some information and payment, we start forming your company! We don’t need any documents to get started. Just sign-up with:

- Your ideal company name

- A personal address (can be anywhere in the world)

- Your email (so we can stay in touch)

*Later in the process you may need your passport to set up your bank account.

Get your U.S. Employer Identification Number (EIN)

All Amazon sellers are required to have a EIN.

Once your company is formed, we start working on your EIN application (Employer Identification Number).

*A U.S. Social Security Number (SSN) is not needed and we apply on your behalf!

2

3

Run your business finances on one platform

Manage your finances in one place – categorize transactions , send customized invoicing, maximize tax deductions, get paid, pull Stripe fees, and send money.

Grow your business

and stay compliant

Simplify your life with doola’s services! We’re here to support your e-commerce venture. With doola Books, our bookkeeping software, and doola Tax Package, we make your life easier. Stay compliant effortlessly and focus on growing your business. Trust doola to simplify your financial management and ensure success in the world of e-commerce.

Your business in-a-box.

4

5

Business insurance

Quote, bind, pay for, and actively manage insurance policies in a matter of seconds. Choosing the right business insurance can help protect you from costly risks and liabilities.

- Fully waived agency fees ($0)

- Fulfill all e-commerce marketplace insurance requirements

- Property damage or inventory replacement

- Customer injuries or product liability insurance

E-commerce partners

For services that we don’t offer, we recommend our trusted partners.

Start your business from India like Mazeer

I was looking for a partner who was responsive, number one, and who had the ability, the flexibility to, accommodate the rapid changes that any business will need… These people [doola] know what they’re talking about. Read more

Mazeer Mawjood

Founder of AuroraRCM

Start your business from Spain like Manja

I would recommend doola because it’s a hassle-free experience. You don’t need to spend hours on researching how to start a company, what documents you need to fill in, ect. It’s a one-stop place to start your business. Read more

Manja Munda

Co-founder of Grow & Scale

Start your business from USA like Calvin

But then once I found out about doola, I then re-registered my LLC there and honestly, there was a night-and-day difference compared to doing it yourself, in a significantly better process than using a service like [other competitors]… Read more