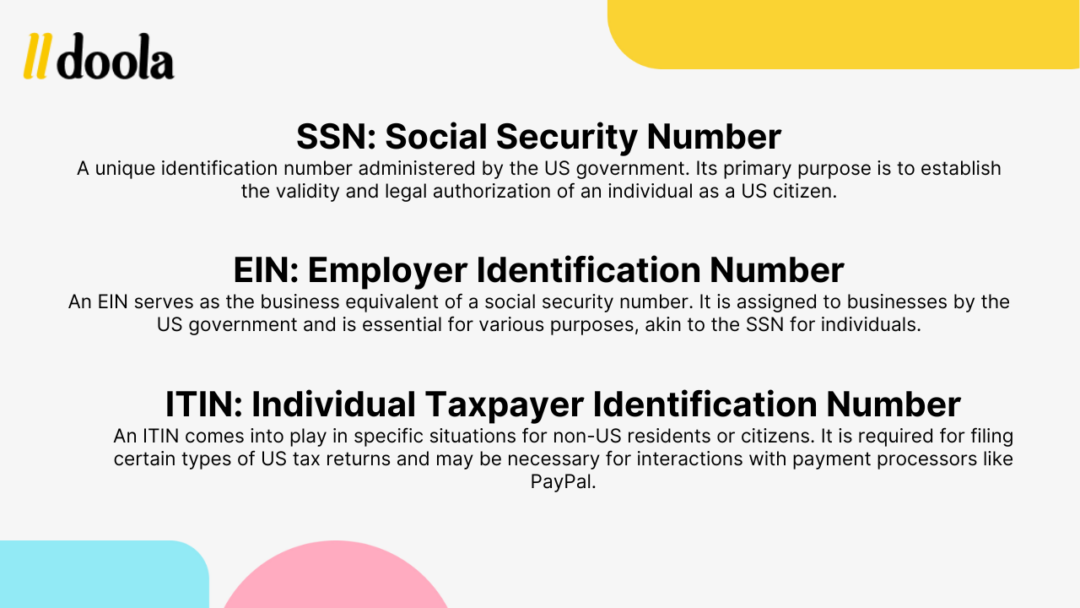

Do I need an SSN, EIN, or ITIN?

Understanding the acronyms SSN, EIN, and ITIN is crucial, especially when registering a business in the US. So, let’s break it down.

SSN: Social Security Number

Definition: The Social Security Number (SSN) is a unique identification number administered by the US government. Its primary purpose is to establish the validity and legal authorization of an individual as a US citizen.

EIN: Employer Identification Number

Definition: The Employer Identification Number (EIN) serves as the business equivalent of a social security number. It is assigned to businesses by the US government and is essential for various purposes, akin to the SSN for individuals.

ITIN: Individual Taxpayer Identification Number

Definition: The Individual Taxpayer Identification Number (ITIN) comes into play in specific situations for non-US residents or citizens. It is required for filing certain types of US tax returns and may be necessary for interactions with payment processors like PayPal.

Feel free to download our quick reference graphic below so you have it in hand!

Overview

Contrary to popular belief, you don’t need an SSN to form a US company. While an SSN can expedite aspects of the process, it’s not mandatory for US business bank account setup.

If you’re concerned about whether or not you need an ITIN, talk to a tax professional. But remember those are only required in specific circumstances, such as filing certain US tax returns or when dealing with payment processors like PayPal.

Key points:

- An EIN is a prerequisite for opening a US business bank account.

- To obtain an EIN, you must first have a US company in place.

- Having an SSN is not mandatory for forming a US company, although it can streamline certain processes.

Get Started With doola

Not sure how to proceed with forming a US company? We’ve got you! If you have any lingering questions or need more guidance, feel free to reach out.

Check out our FAQ page and the full list of our Business Solutions to see which one is right for you!

Here’s to a smooth business journey!

Keep reading

Get started with doola and launch your US business

Turn your dream idea into your dream US business, today.