Formation API

Create a US company from the command line

Streamline internal operations and create a new, lucrative revenue line by offering company formation.

Formation API powered by doola

Only 3 simple steps.

1

Tell us what exactly you’re looking for

LLC? C-Corp? DAO LLC?

All of the above?

You say jump. At doola we say how high.

Let us know what type of company you’re looking to form and the expected volume (we can handle the volume, don’t worry).

Onboarding call + a custom package

If there’s a strong fit, you’ll chat with us to walk through everything doola has to offer as well as a detailed plan outlining how doola can integrate with your company.

Embed doola for a “powered by doola” experience.

2

3

Launch with dedicated support

Slack? Telegram? Whatsapp? Email?

All of the above?

We’ll meet you where you are and you’ll have a dedicated account manager at doola to help with support for your companies.

What are you waiting for? Just do(ola) it 💪

Our Partners

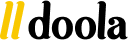

Become a partner with doola for company formation

Turn any wallet into a web3-native investing DAO

Within the next decade, investing will be decentralized, democratized, and community-driven. Syndicate is building web3-native infrastructure that will empower communities to raise, coordinate, and invest capital like never before. However, many investing DAOs need a way to easily create a legal entity, get a U.S. bank account, and manage ongoing state compliance and tax filings. We’re excited to partner with doola so DAOs on Syndicate can do what they love and are best at, investing, while doola handles the rest.

Invest in tokenized real estate for only $50

Lofty AI lets you diversify into real estate investing in less than 5 minutes for only $50. Lofty AI properties are liquid. You can sell your tokens any time for no fees or penalties. Each property has been vetted by their flagship A.I. and a local boots-on-the-ground investor. You receive daily rental income and tokens update in value on a monthly basis based on the value of the property itself. doola helps Lofty AI easily launch LLCs so they can focus on what they do best: real estate investing, while doola handles the paperwork and filings.

Start your business from India like Mazeer

I was looking for a partner who was responsive, number one, and who had the ability, the flexibility to, accommodate the rapid changes that any business will need… These people [doola] know what they’re talking about. Read more

Mazeer Mawjood

Founder of AuroraRCM

Start your business from Spain like Manja

I would recommend doola because it’s a hassle-free experience. You don’t need to spend hours on researching how to start a company, what documents you need to fill in, ect. It’s a one-stop place to start your business. Read more

Manja Munda

Co-founder of Grow & Scale

Start your business from USA like Calvin

But then once I found out about doola, I then re-registered my LLC there and honestly, there was a night-and-day difference compared to doing it yourself, in a significantly better process than using a service like [other competitors]… Read more