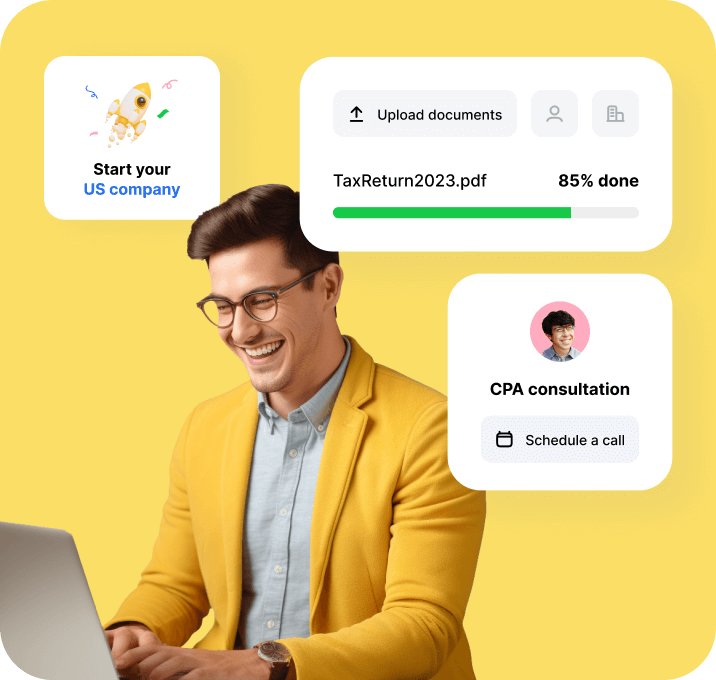

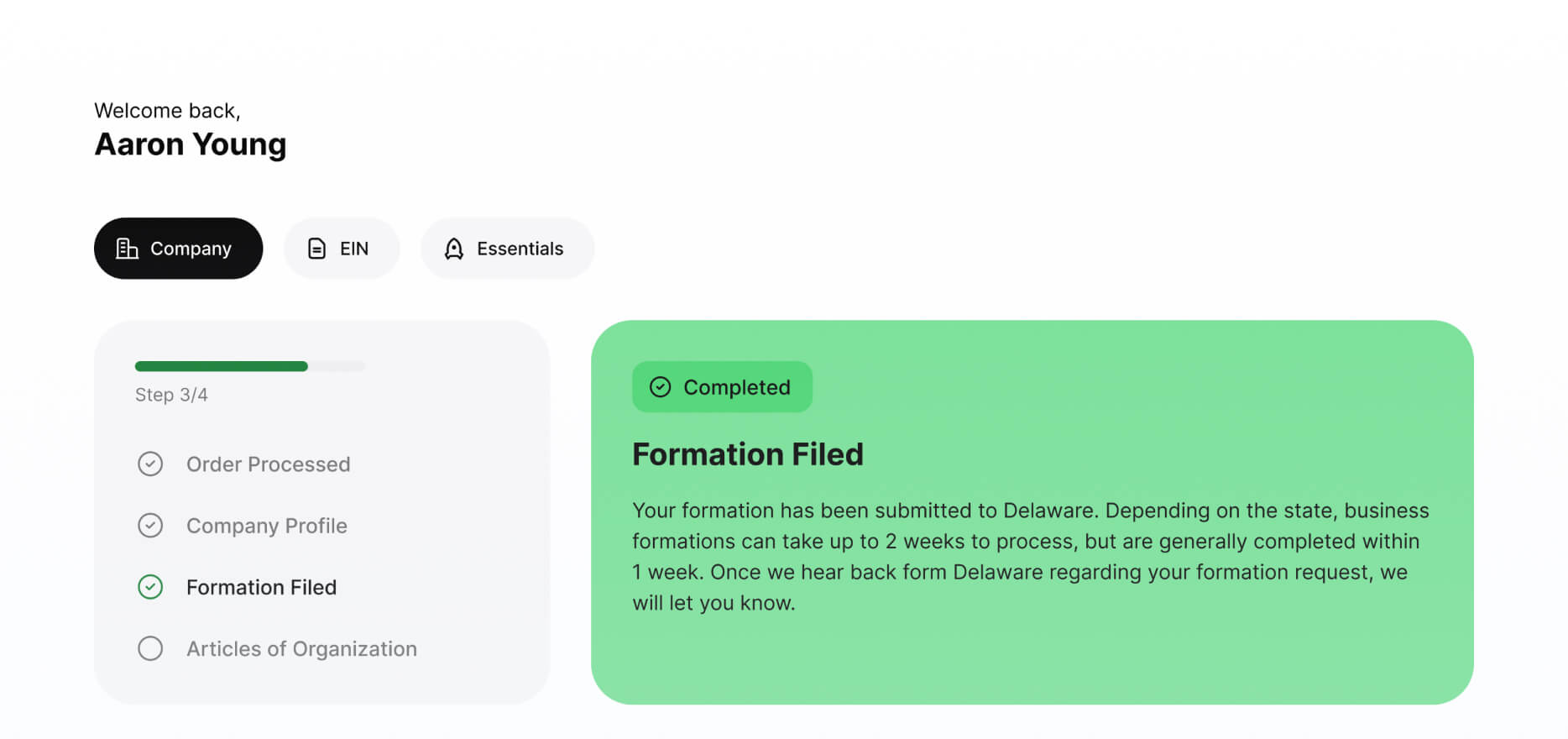

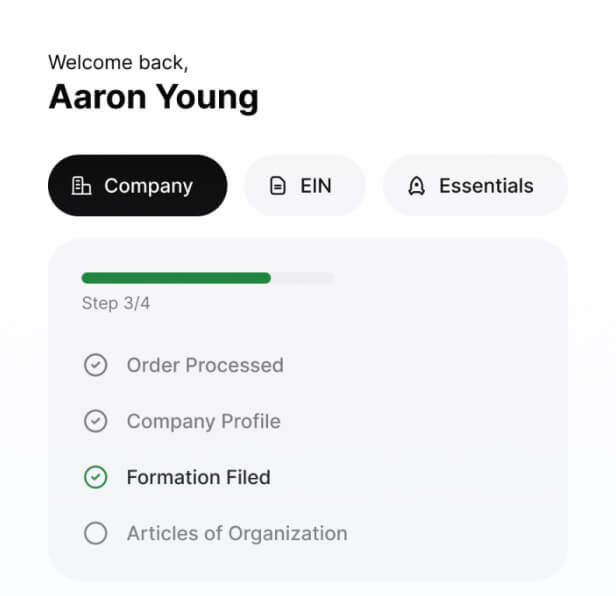

Form your US company from anywhere in the world.

Form your US company effortlessly with doola—no SSN required. We handle LLC, C-Corp, and DAO LLC formations. Our all-inclusive service covers Employer Identification Number (EIN), Registered Agent service, and Operating Agreement, all without hidden fees.

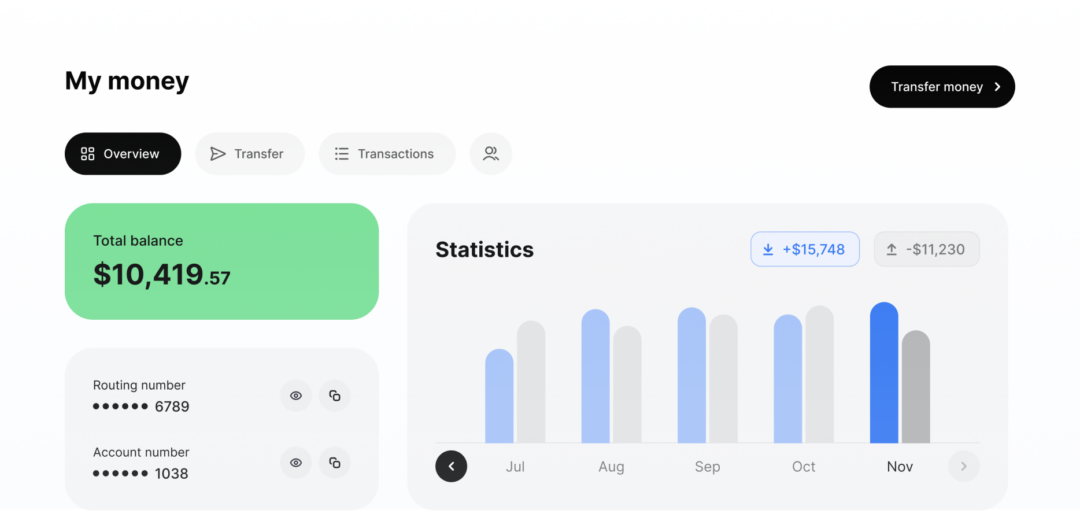

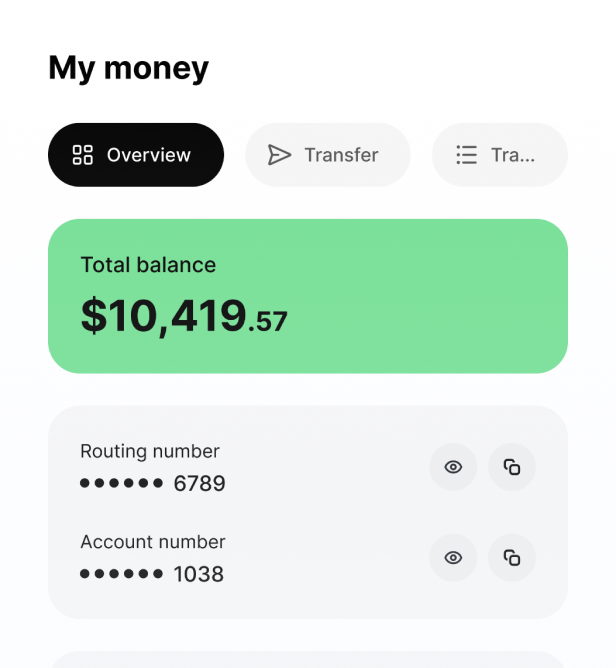

International transfers to 100+ countries.

Introducing a powerful, low-cost solution for international money transfers. doola Money facilitates transactions in local currencies worldwide with the added convenience of deposits in $USD. No Social Security Number (SSN) is required to open an account, making it the ideal solution for founders around the globe.

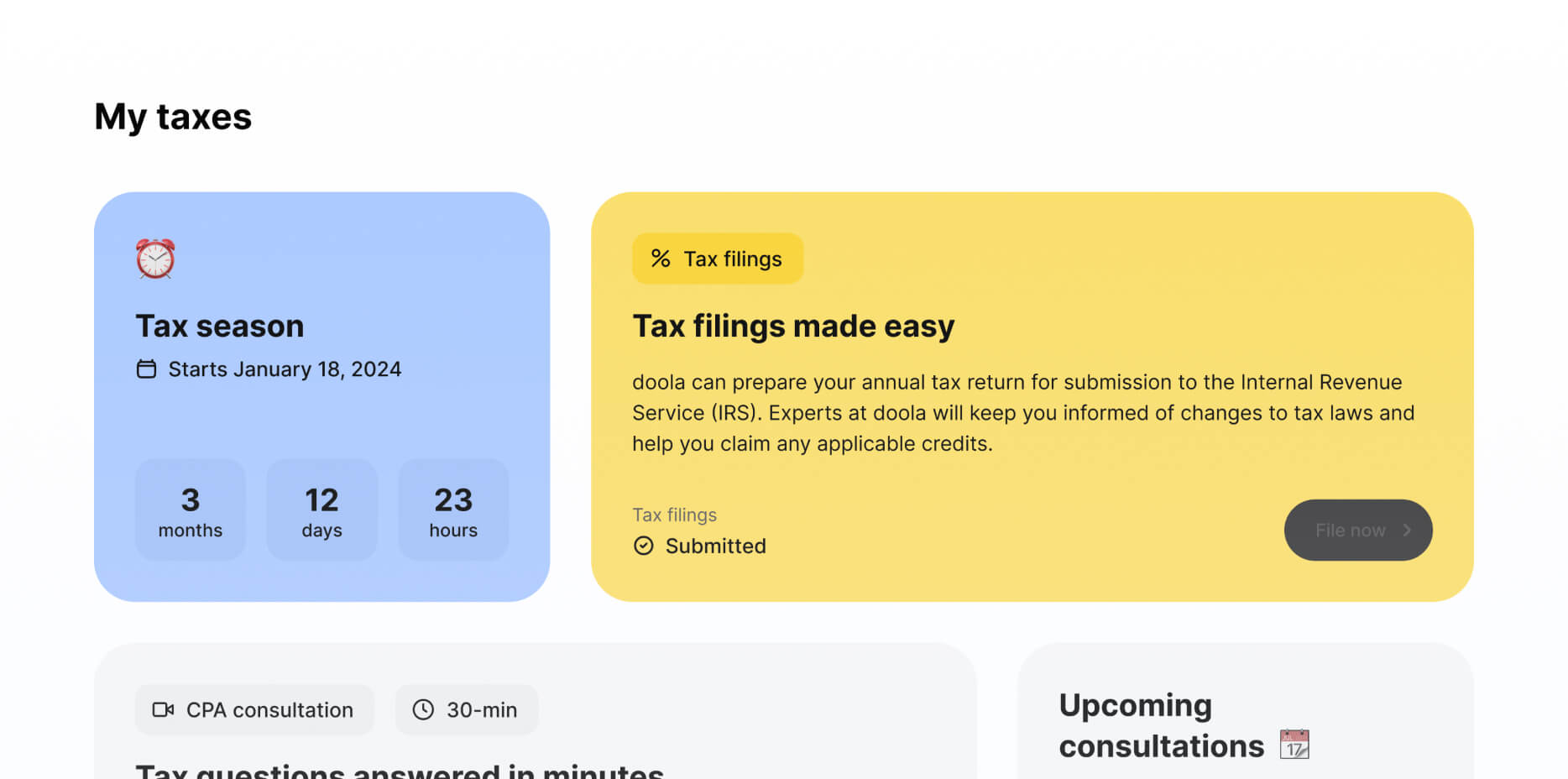

Embrace worry-free tax filings.

Ensure 100% IRS and state compliance with the added benefit of a free CPA consultation. Avoid fines up to $25,000 and simplify your tax season with our dedicated support and transparent processes.

Your personal account manager for dedicated support.

Enjoy dedicated support, guidance, and comprehensive answers to all your queries. Seamlessly navigate the complexities of running and growing your business with personalized assistance.

- Adamma 👩

- Legal consultant 🖥️

- Started a US LLC 🚀

- From Nigeria

Unleash

your success now

Starter

Start your business 🏁

Formation & EIN filings, RA service, Operating Agreement, and regular compliance reminders.

State fee not included.

$297 /yr

Total Compliance

Stay 100% compliant 🚀

Formation with Expedited processing, Annual State filings, IRS Tax filings, a dedicated Account Manager and a free CPA consultation.

State fee not included.

Each state charges a one-time formation fee. Your state fee will vary depending on the state you form in. Not sure which state to choose? Take our quiz →

Start your business from India like Mazeer

I was looking for a partner who was responsive, number one, and who had the ability, the flexibility to, accommodate the rapid changes that any business will need… These people [doola] know what they’re talking about. Read more

Mazeer Mawjood

Founder of AuroraRCM

Start your business from Spain like Manja

I would recommend doola because it’s a hassle-free experience. You don’t need to spend hours on researching how to start a company, what documents you need to fill in, ect. It’s a one-stop place to start your business. Read more

Manja Munda

Co-founder of Grow & Scale

Start your business from USA like Calvin

But then once I found out about doola, I then re-registered my LLC there and honestly, there was a night-and-day difference compared to doing it yourself, in a significantly better process than using a service like [other competitors]… Read more